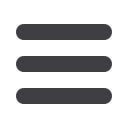

At 31 March

At 31 March

Assets

2017 2016 Liabilities

2017 2016

£’bn £’bn

£’bn £’bn

Money market assets,

due from banks and

building societies

34.5 48.4 Deposits due to banks and

building societies**

10.6 11.3

Loans, advances and

assets leased*

7.5 8.3

Deposits due to customers

31.0 43.9

Investments

0.9 0.7

Other deposits (held as

security and interest payable)

including deposits due to

public sector bodies

0.3 0.4

Other assets

0.4 0.5

Other liabilities

0.4 0.4

Capital and Reserves

1.0 1.9

Total assets

43.3 57.9 Total liabilities

43.3 57.9

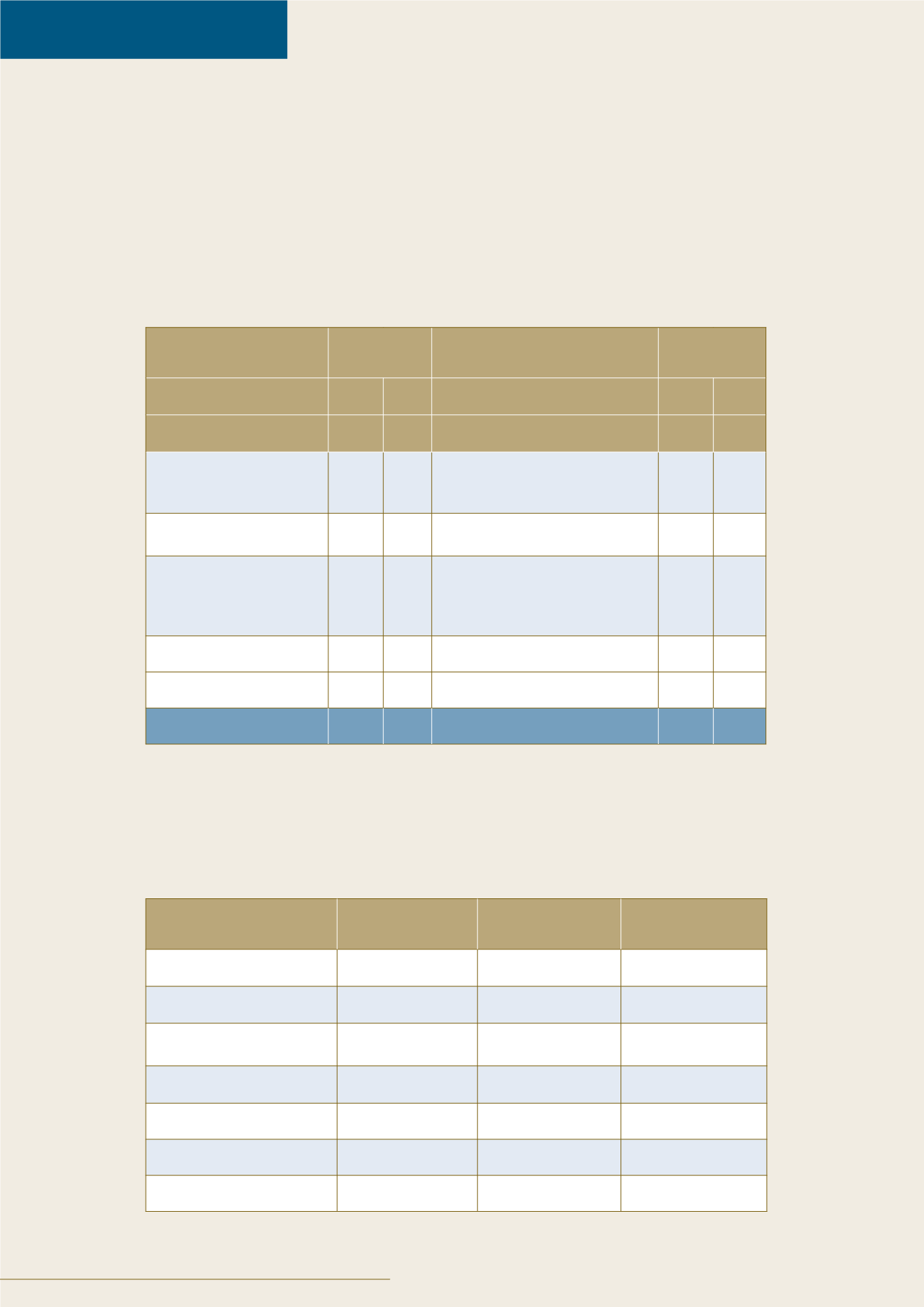

Country

31 March 2017 31 March 2016

31 March 2015

Isle of Man

35%

25%

25%

United Kingdom

29%

41%

41%

European Union

(excluding UK)

6%

6%

6%

Europe (Non-EU)

2%

2%

5%

Middle and Far East

7%

6%

6%

North America

4%

4%

4%

Other

17%

16%

13%

APPENDIX D

42 • Isle of Man Financial Services Authority Annual Report 2016/17

ASSETS AND L IABI L I T I ES OF L ICENSED BANKS

The data includes figures relating to overseas branches of Isle of Man incorporated banks. At

March 2016 the data included the business of the Jersey and Guernsey branches of Barclays

Private Clients International Limited (an Isle of Man company); this bank transferred all of its

business in the Isle of Man, Jersey and Guernsey to branches of Barclays Bank PLC in each island

in October 2016 and surrendered its licence. Therefore, the data at March 2017 only includes

the Isle of Man business of Barclays Bank PLC.

GEOGRAPHICAL SOURCE OF NON-BANK DEPOS I TS

* At 31 March 2017, 51.3% of loans, advances and assets leased were classified as being secured on residential property

(31 March 2016: 61.0%). The above figures relating to loans and advances are net of impairment charges.

** Includes deposits/loans received from other Isle of Man banks of £2.01bn (2016: £3.35bn).